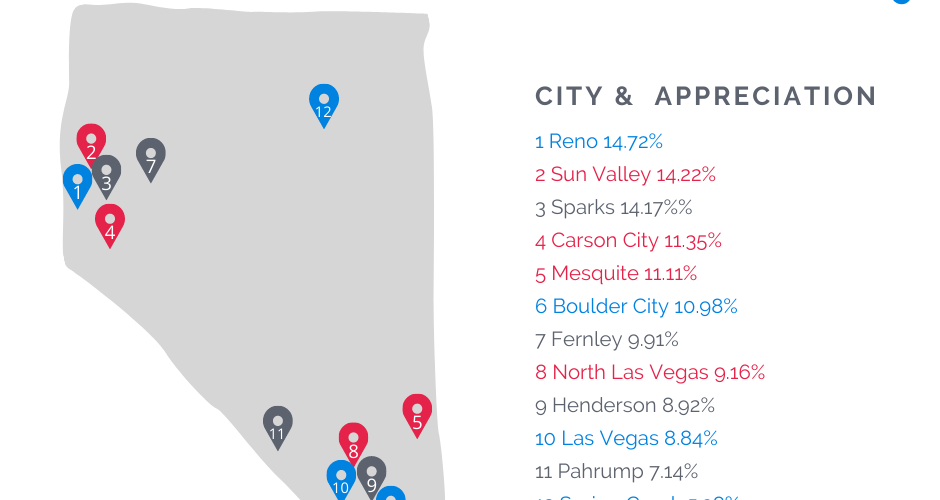

Since COVID-19, there has been an average of 9.87% increase in home value in the state of Nevada. We have accumulated the top 12 cities in Nevada with most appreciation from March 2020 to March 2021. Although there are some cities with a greater increase included on the list, we have selected cities with at least a 10,000 person population.

Add this unprecedented home value increases to the fact that we have super low rates in history, and now may be a good time to consider home refinancing.

If YOU OWN a home, cashing out some of that equity gain for other purposes may be a wise decision… when else can you borrow from yourself at record-breaking low rates? Get a quick rate quote here.

| City | County | March 2021 Typical Home Value | Home Value Appreciation During Covid | Estimated Population |

| Reno | Washoe | $467,964 | 14.72% | 246,500 |

| Sun Valley | Washoe | $351,670 | 14.22% | 21,159 |

| Sparks | Washoe | $422,827 | 14.17%% | 100,589 |

| Carson City | Carson City | $383,165 | 11.35% | 54,773 |

| Mesquite | Clark | $310,909 | 11.11% | 18,446 |

| Boulder City | Clark | $366,961 | 10.98% | 15,840 |

| Fernley | Lyon | $309,861 | 9.91% | 20,068 |

| North Las Vegas | Clark | $302,313 | 9.16% | 241,369 |

| Henderson | Clark | $379,314 | 8.92% | 300,116 |

| Las Vegas | Clark | $319,165 | 8.84% | 634,773 |

| Pahrump | Nye | $258,506 | 7.14% | 37,298 |

| Spring Creek | Elko | $295,311 | 5.38% | 13,671 |

Should you cash out or refinance at this time? It all comes down to dollars and cents.

Use our calculator or request a quote to see how much more we can leave in your pocket: