Many customers are surprised that despite a decent-enough credit score, a stable job, and reasonable income, they still don’t qualify to buy as much house as they thought. Even worse, sometimes they don’t even qualify at all.

When they hear the news, they either get annoyed then kick and pound the table, or they sit there in disbelief looking at how their debt has eroded away their credit capacity and therefore destroyed their ability to take on a mortgage loan.

After the shock and realization that their debt management habits need some adjusting, the question inevitably comes: now what?

How to Fix it

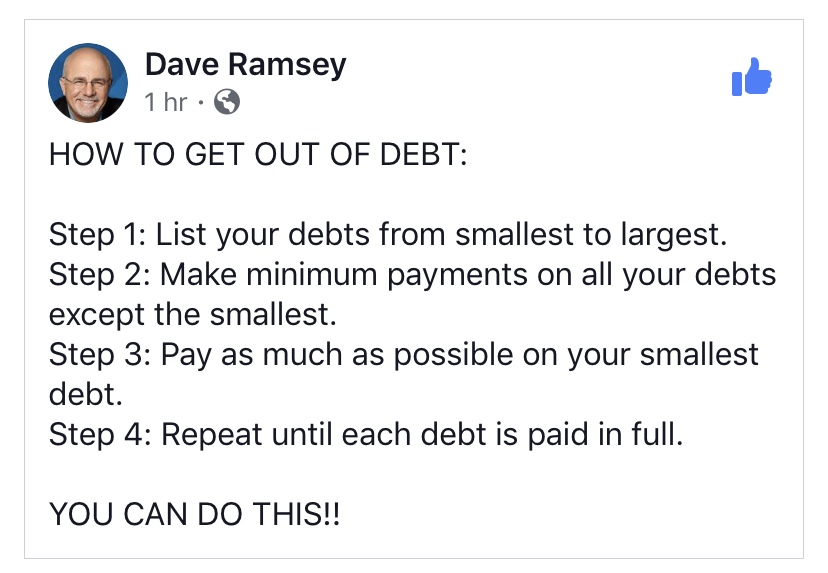

There’s no simpler way than Dave Ramsey’s debt snowball method, where you lost your debt sorted by balance amount and pay off your lowest balance debt first, then going down the list from there.

Why it Works

While this approach has been criticized by some who say it’s better to focus on high interest debt first, research done by the Kellogg School of Management has found that the debt snowball method is generally effective. Paying off smaller debt first provide small victories that serve as motivation to get going. A 2016 study by Harvard Business School found that people who used the snowball method to pay off their smallest account first, paid down more of their debt than those who used other methods.

Where To Start

The first step is to understand your debts. Download a credit monitoring tool such as CreditKarma or Credit Sesame. Banks also provide credit monitoring through their credit card or banking services.

You can also request a copy of your credit report from SnapFi:

https://www.snapfi.com/improve-your-credit/request-a-free-credit-report/#

Read Further

You’re More Than a Credit Score: What Factors Matter to Your Mortgage Lender?

Long Term Habits to Improve Your Credit Score Beyond The Basic Number

eBook: Credit Boosting, a Guide to Improving and Maintaining a Good Credit Score