-

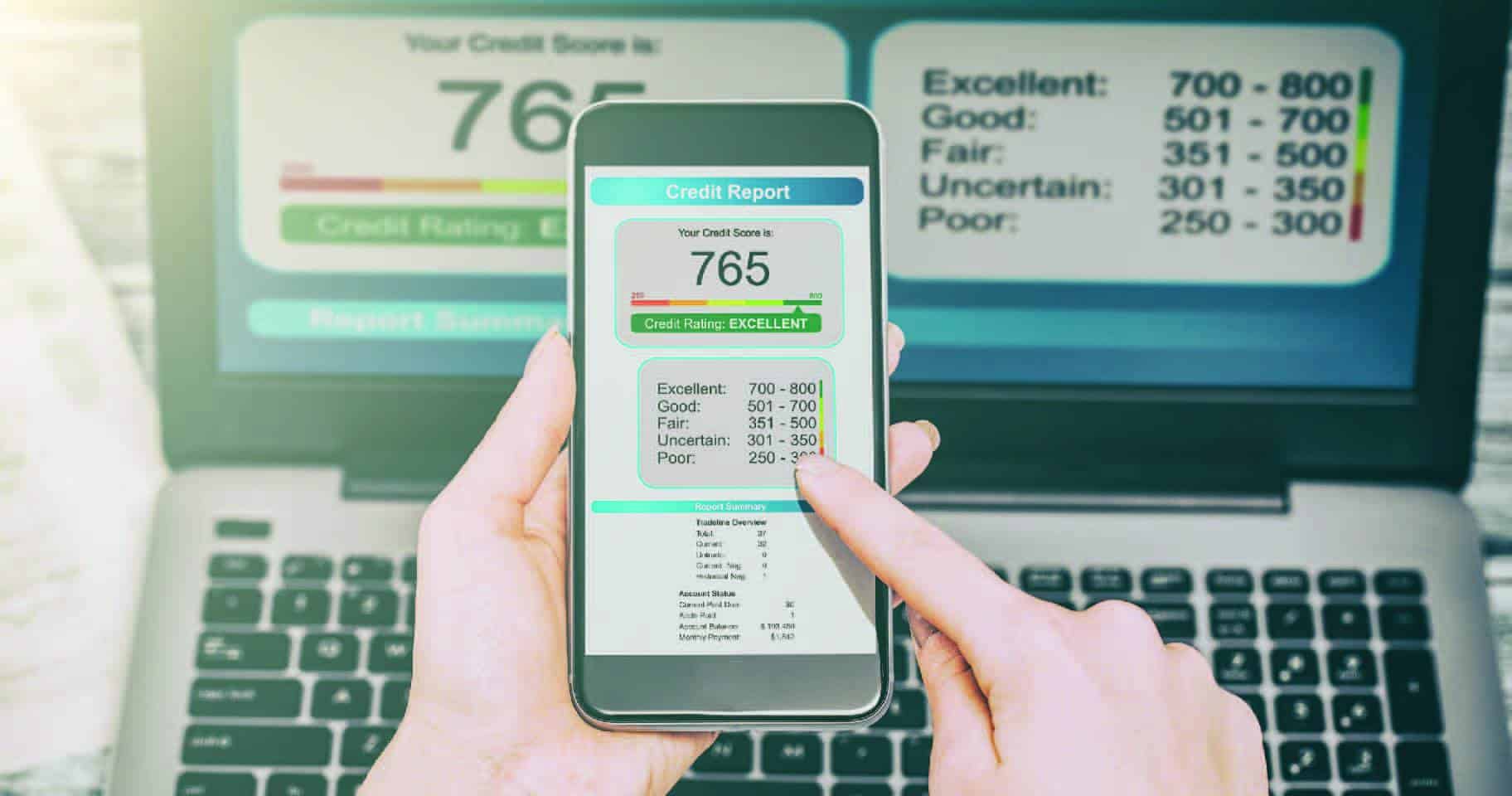

If you’re not sure what your credit looks like right now, or even if you are, and you would like to get started on the path to home ownership, this is a perfect opportunity to get a complimentary copy of your credit report and then to speak with a trusted lending expert.

-

debt-to-income ratio are more likely to run into trouble making monthly payments.

-

To calculate your debt-to-income ratio you simply add up all your monthly auto, installment and revolving debt payments (you do not need to include groceries, electric, phone etc.) and divide them by your gross monthly income.

-

For example if you pay $1500 a month for your mortgage and another $100 a month for an auto loan and $400 a month for the rest of your debts, your monthly debt payments are $2000.

-

If you’re not sure what your credit looks like right now, or even if you are, and you would like to get started on the path to home ownership, this is a perfect opportunity to get a complimentary copy of your credit report and then to speak with a trusted lending expert.

-

debt-to-income ratio are more likely to run into trouble making monthly payments.

-

To calculate your debt-to-income ratio you simply add up all your monthly auto, installment and revolving debt payments (you do not need to include groceries, electric, phone etc.) and divide them by your gross monthly income.

-

For example if you pay $1500 a month for your mortgage and another $100 a month for an auto loan and $400 a month for the rest of your debts, your monthly debt payments are $2000.

GETTING READY TO BUY OR REFI?

Request Your Free Credit Report

It'll cost you zilch, nothing, nada.