Home prices are also stabilizing: from a whopping 17.2% increase in the last 12 months cooling down to a normal 3.2% home value appreciation forecast for the next 12.

This makes it an ideal opportunity to refinance OR purchase a home.

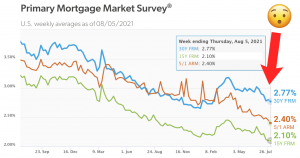

Mortgage Rates Dip (AGAIN)

“With global market uncertainty surrounding the Delta variant of COVID-19, we saw 10-year Treasury yields drift lower and consequently mortgage rates followed suit. The 30-year fixed-rate mortgage dipped back to where it stood at the beginning of 2021, and the 15-year fixed remained at its historic low. This bodes well for those still looking to refinance, renovate or even purchase a new home.” ~FreddieMac’s Primary Mortgage Market Survey® on August 5, 2021

Time to save before rates rise again.

Let us crunch some numbers, see if it makes sense for you:

✅ Lock a low rate

✅ Save money overtime

✅ Pay your mortgage down

✅ Lower your monthly payment

✅ Cash some money out

Let us Crunch Numbers

Call 800 816 5626 now or chat with a Home Loan Expert by requesting a quick quote: