The Federal Housing Finance Agency (FHFA) announced Friday, July 16th that it would be eliminating the adverse market refinance fee from Fannie Mae and Freddie Mac home loans, making refinancing a mortgage cheaper for homeowners.

The elimination will apply to all mortgage loans beginning Aug. 1, 2021. The 50-basis point fee was instated last year by the Trump administration amid the COVID-19 pandemic, as Fannie Mae and Freddie Mac saw their profits decreasing due to the mortgage giants’ programs to help struggling families during the pandemic.

“The COVID-19 pandemic financially exacerbated America’s affordable housing crisis,” FHFA Acting Director Sandra L. Thompson said in a statement. “Eliminating the Adverse Market Refinance Fee will help families take advantage of the low-rate environment to save more money.”

With the controversial adverse refinance market fee removed, many borrowers could save even more money on their home loan through a refinance.

Want to take advantage of the reduced cost?

“Santa Claus has come early for homeowners looking to refinance their mortgages,” said Greg McBride, chief financial analyst for Bankrate.com. “The fee had often resulted in an increase of one-eighth percentage point in rate, which was enough to siphon $20 per month in potential savings out of the pockets of borrowers with a $300,000 loan.”

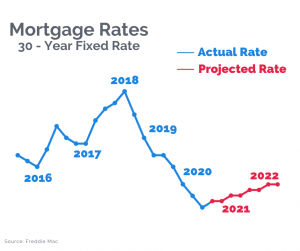

Mortgage rates recently dropped and are now sitting near a five-month low. Applications to refinance jumped in the last two weeks, according to the Mortgage Bankers Association, and will likely move even higher with this additional savings.

What is the adverse market refinance fee?

The adverse market refinance fee is a 0.5% fee added in 2020 to refinanced mortgage loans backed by Fannie Mae and Freddie Mac (about 70% of all home loans). It was charged to lenders and usually passed on to homeowners through closing costs, as an addition to their loan amount or by a raised interest rate. As a result, borrowers were paying an extra $500 for every $100,000 they refinanced.

The FHFA said in a statement that the fee “was designed to cover losses projected by the COVID-19 pandemic,” and that the effectiveness of its coronavirus-related policies warranted “an early conclusion” of it. With interest rates still at all-time lows and the adverse market refinance fee removed, more borrowers than ever can now benefit from a mortgage refinance.

How much will homeowners save with the elimination of the refinance fee?

The median price of a home in the U.S. is $287,148 as of May 2021, according to the latest report from Zillow. That would leave homeowners paying an extra $1,435 to refinance their home with the addition of the 0.5% adverse market refinance fee. Of course, many homeowners do not refinance the full amount of their mortgage due to payments on it and lowering their amount owed.

That amount of the fee can either be paid upfront or added to a loan amount. If homeowners are given the option to add the fee costs to their loan amount, they’d see an uptick in their monthly payments. It would add about $4 per month for a mortgage financed out for 30 years, and about $8 per month for a loan financed out for 15 years.

Why is the FHFA removing the adverse market refinance fee?

In June, the Supreme Court ruled that the FHFA’s leadership structure was unconstitutional, allowing President Joe Biden to remove then-Director Mark Calabria and appoint a new leader. Under the current direction of Sandra Thompson and Biden’s administration focusing more on affordable housing, the FHFA is making so

me changes, rather than setting up Fannie Mae and Freddie Mac to be removed from government care.

The fee was originally set to take effect Sept. 1, 2020, but that date was later pushed to give lenders more time to prepare. The FHFA started collecting the fee on Dec. 1,

2020.

How to get a low refinance rate

Interest rates are currently averaging well below the 3% mark for a 30-year fixed-rate mortgage, according to the latest Primary Mortgage Market Survey from Freddie Mac. Low rates, combined with the refinance fee’s elimination and rapidly rising home prices, make now a perfect time to refinance.

Ready to get your rate?