So often “would-be homebuyers” tell me that they are bummed they didn’t buy a home during the peak home buying season last year because mortgage rates were good and the housing market was hot.

Well, my friends, you’re in luck because so far, this year’s peak home buying and selling season looks to be favoring the buyer even more than last year. And much of that is due to your increased ‘buying power’ (Of course, as we know, markets and rates can change at any moment).

Maybe you’ve heard the term ‘buying power’ used by cable network business news anchors or fancy bankers, but simply put, buying power means that your purchasing dollar goes further the lower your mortgage rate is. So, in a lower mortgage rate environment like we’re seeing right now, you have more home choices in a greater range of prices.

Want to see the real numbers? [Cue 80’s hit song: I’ve Got the Power]

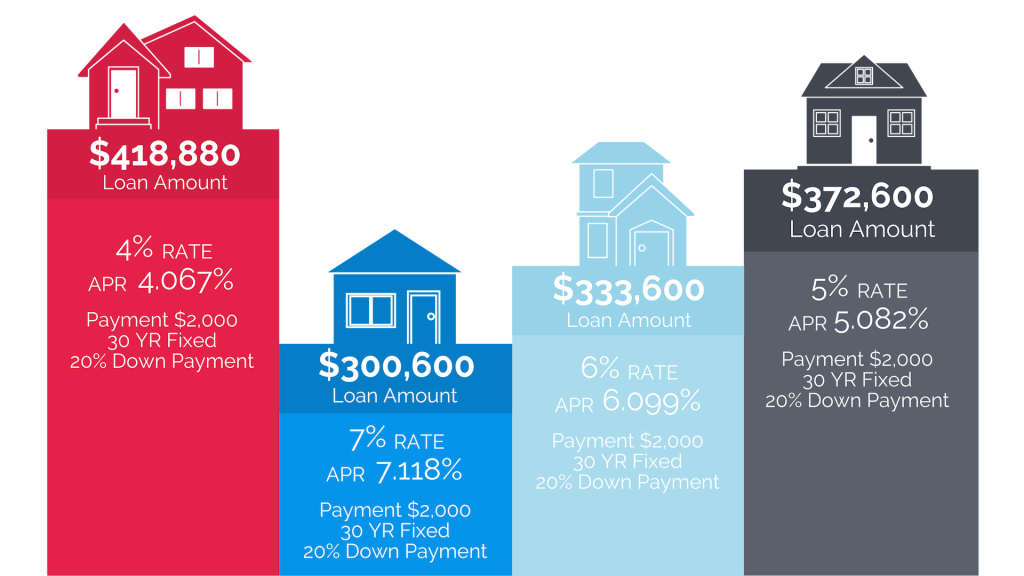

Let’s say your target monthly mortgage payment (principal & interest) is $2,000. Here’s how far your monthly mortgage payment* of $2,000 would go based on the interest rate of your mortgage:

4% rate (4.122% APR) = $523,600 home price* / $418,880 loan amount

5% rate (5.138% APR) = $465,750 home price* / $372,600 loan amount

6% rate (6.156% APR) = $417,000 home price* / $333,600 loan amount

7% rate (7.176% APR) = $375,750 home price* / $300,600 loan amount

*all scenarios based on 30-yr fixed rate mortgage with 20% down payment. Monthly payment of $2,000 only principal and interest, not including home owners insurance or property taxes.

Right now, your buying power is made even greater with moderating home appreciation rates (or the rates at which home prices increase), a strong economy, and healthy job market. Plus, the housing inventory – which was such an issue for many buyers last year – has improved with more homes going on the market so you have more to choose from.

Anyway you slice it, the pendulum has swung closer to being a buyers market. However, even though market factors are in buyers’ favor, there are a few steps you can take to increase your buying power even more! Consider decreasing your debt load, taking steps to increase your credit score, and increase your savings for the down payment.

We are always happy to examine different scenarios with you to see how we can help you maximize your buying power. Reach out. We’re here to help!