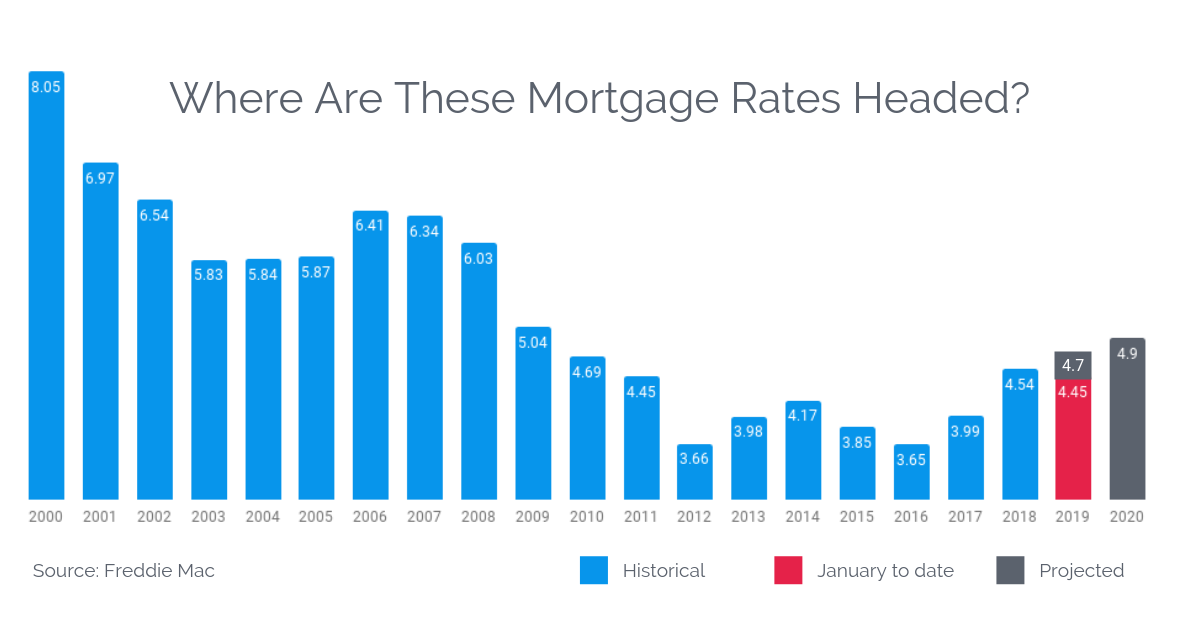

Rates may be on the rise but…

RATES ARE STILL HISTORICALLY LOW.

The fluctuation of interest rates is normal. Looking at the big pictures is key. Your personal financial scenario also plays a significant role. The only way to know if it’s the right time for you to buy, is to talk to a mortgage professional to crunch your numbers and explore loan scenarios.

What’s important to know here is…

FIRST: Nowhere to go but up?

We will never know with 100% certainty where rates will end up in 2019 and beyond. But what we do know is that current indicators and Freddy Mac projections point to continuing increases in mortgage interest rates. These current projections should be enough for consumers to seriously consider buying or refinancing now.

SECOND: Increasing rates impact your purchasing power

It’s well known that the higher the rate, the lower your total home purchasing power, and subsequently the higher your monthly payment. Locking a rate now could mean the difference between a 3-bedroom home and a 4-bedroom home with more space for your home office. Or even that little in-law cottage unit in the back.

THIRD: Timing the market is likely to be futile

Many people like to “time the market” and wait for the perfect time. Some customer have told us they expect home prices to go down and therefore prefer to wait it out. Because interest rates are STILL near historic lows, you must consider that even if home prices go down, the effect of increasing interest rates will work against your overall financial position to buy. History shows that if you’re in the market for a home that you will keep for more than 3 years, timing the market is likely to be a futile endeavor.

CHECK YOUR INTEREST RATE

No obligation. Takes 3 mins. We aim to beat competitors always.

Graph: Average Annual 30 Year Interest Rates, January to-date, and projected 2020.

Sources: http://www.freddiemac.com/pmms/pmms30.html & http://www.freddiemac.com/research/forecast/20190129_economic_growth.html