Interest rates have been a hot topic for debate since the recession that began late in 2007, and for good reason. One of the strategies implemented in a time of economic downturn is to adjust interest rates down, with the intent of encouraging more lending among banks. These interest rate adjustments implemented by the Federal Reserve are focused on short-term interest rates, and as the economy begins its climb out of a recession, rates are adjusted up to promote continued growth. While interest rate movements are not directly correlated to long-duration rates, their impact extends well beyond a financial institution’s cost of doing business with another financial institution – down to the everyday consumer.

Since 2015, the Fed has slowly started increasing the federal fund’s rate, and there is a strong likelihood that these upticks will continue through the next two years. That’s good news from a broad economic perspective, but these changes reach homeowners who currently have adjustable rate mortgages in a way many may not be aware. To figure out why, and the steps homeowners can take to save themselves from financial difficulty, we must look to and understand the yield curve.

Breaking Down the Yield Curve

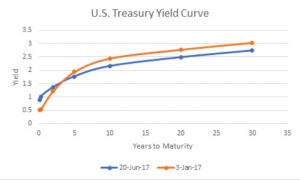

The yield curve is simply the difference between the yields on short- and long-term maturity bonds, and it is used as a predictor of economic growth. The direction of the yield curve based on a given interest rate environment is measured by comparing the yields on two-year and 10-year treasury bonds. In typical markets, the yield curve trends upward based on the premise that bond investors need to be compensated more for the greater amount of time they are required to hold a bond.

In today’s environment, the yield curve is flattening.

Source: Treasury.gov

This means that that the difference between short- and long-term yields is minimal, creating a slope that is neither rising or falling. When short-term interest rates rise without long-term interest rates following suit, the yield curve flattens. The same is true when predictions for inflation and economic growth are slow. A flat yield curve doesn’t stick around long, but while it’s in place, it has an immediate impact on short- and long-term mortgages in that the delta between the interest rates offered on each is small. The rates on adjustable rate mortgages increase as the federal fund’s rate goes up, but fixed rate mortgages don’t rise at the same speed in a flattening yield curve environment. This can mean the competition between fixed rates on long-term conventional mortgages and ARMs is non-existent, because fixed rates are less.

So, for a prospective homeowner, the typical allure of a lower initial ARM interest rate diminishes because fixed-rate, longer-term mortgage rates are either only slightly higher or in some cases, lower. Why not secure a fixed mortgage and eliminate the possibility of a rate adjustment up in the future while the difference is minimal?

It’s important to understand how lenders set the rate on an adjustable rate mortgage to know if getting an ARM makes sense. The process involves two critical components: the index and the margin. The index is a measurement of broad interest rates, like the LIBOR, while the margin is the percentage points added by the lender. As an example, a 5/1 ARM adjusts after the initial fixed-period of five years ends, leaving homeowners with a rate that adjusts to the index interest rate plus the margin they add every year thereafter.

For instance, if the lender’s index is the six-month LIBOR, which is currently 1.78%, and they have a margin of 2.50%, the adjusted rate applied to the ARM is 4.27%. When an ARM is fully indexed, meaning the margin is added to the index rate, homeowners experience interest rates higher than what they would have on a fixed-rate mortgage. New homeowners don’t reap any benefit getting an ARM in the current interest rate environment because fixed rates are less than ARM rates. Current homeowners with an ARM need to refinance into a fixed-rate mortgage as soon as possible to eliminate the risk of having a fully indexed ARM loan that has a higher rate than a fixed loan.

Next Steps for Current Homeowners

For current homeowners with an ARM, a flattening yield curve means now is the time secure a fixed-rate mortgage through a refinance. As in the example above, ARMs are likely to adjust upward after the initial fixed term has passed, leaving homeowners with the reality of a higher monthly payment and a higher interest rate than a fixed mortgage currently offers. Refinancing to a fixed-rate, long-term mortgage like a 15-year or 30-year loan is beneficial for those who want to eliminate the concerns over the yield curve and the potential for rising rates in the future.

Unless the timeframe for owning the home is five years or less and the ARM rate is significantly lower than a fixed mortgage, an ARM in a flattening yield curve market is not the optimal choice. Homeowners who currently have an adjustable rate mortgage that is still within the initial rate period and who plan to sell their home in a short period of time may not have a need to refinance. Having the lowest possible interest rate always makes the most sense, and so making a change when a sale is imminent isn’t necessary. However, homeowners nearing the end of their ARM’s initial rate period need to make a move to a fixed rate mortgage – the sooner the better.

The flattening yield curve also affects homeowners with home equity lines of credit, another form of an adjustable rate mortgage. HELOC interest rates are variable, tied to the prime rate, and so they are directly impacted when short-term interest rates like the federal fund’s rate move up or down. Like ARMs, HELOC lender determine a homeowner’s interest rate by adding a margin to the prime rate, currently at 4.50%. These figures adjust every quarter, creating a costly situation for homeowners who actively use their HELOC. A fully indexed HELOC can quickly exceed the interest rate on a fixed-rate mortgage just like an ARM, laying the foundation for a refinance while long-term interest rates are still relatively low.

While the Federal Reserve’s changes to short-term interest rates over the next few years may not directly impact long-term mortgage rates, the yield curve plays a critical role in the process of ARM and HELOC adjustments. Now is the time for homeowners with an ARM or a HELOC to evaluate their need and desire to lock in a fixed rate for the long haul, providing more stability and predictability in their mortgage obligation moving forward.

If you need advice or would like to discuss your options with a knowledgable Mortgage Advisor, contact us today!