There are a lot of factors that can influence your ability to get your mortgage. There’s your income, your total debts (student loans, car loans, credit cards, etc.), your employment history and even how much you have in savings.

But one of the most important? That’d be your credit score.

The Low-down: Credit Scores and Mortgages Go Hand in Hand

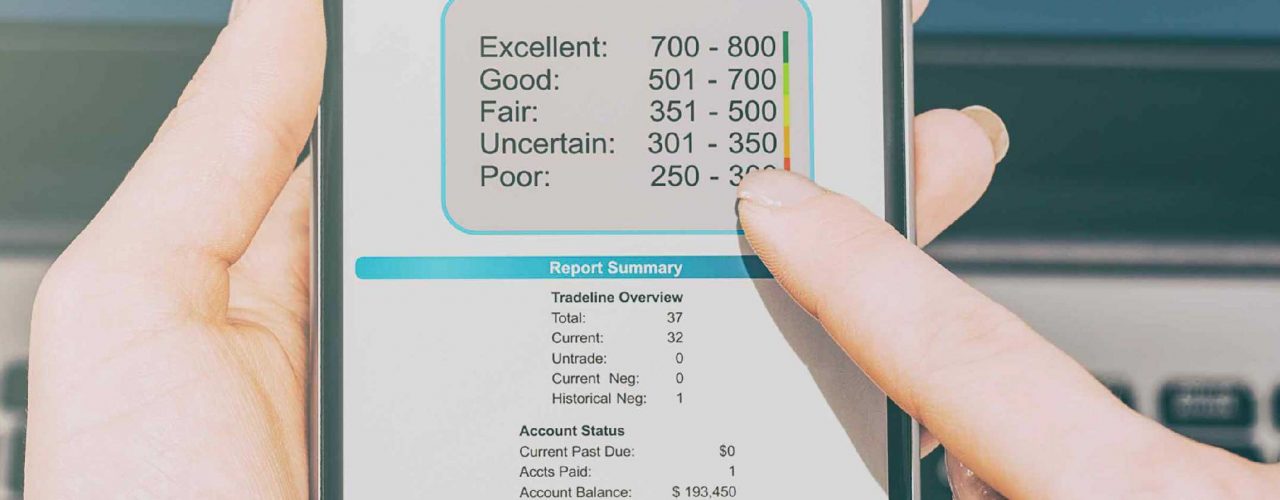

Your credit score — also known as a FICO score — says a lot about your financial health. Your payment history, the amount of time you’ve had your accounts open, your outstanding balances (and more) all impact your score, and the better you are at paying your bills in full and on time, the higher that score will be.

And a high score? Well, that tells a lender you’re a safe bet as a borrower.

That you’ll pay your mortgage on time.

That you won’t default and go into foreclosure.

That you deserve a low mortgage rate.

Now that doesn’t mean you can’t get a mortgage with a less-than-ideal credit score (a perfect score is 850, for reference.) It just means it may be harder and more expensive in the long run.

Plenty of people buy a home or refinance with nowhere near perfect credit, and a score as low as 580 will still qualify you for a low-down payment loan from the Federal Housing Administration. But if you want an easier road and a potentially lower monthly payment? Read on.

Boosting Your Score for a Better Shot

In the end, a better credit score will mean an easier approval process and a more manageable mortgage payment as a homeowner.

So what can you do to boost that score and reap the benefits? While there’s no quick fix, there are a few things you can do in the months leading up to your mortgage application that can send your score in the right direction.

Here are a few:

Reduce your debts.

Start paying down your debts, be they credit cards, student loans, car loans or any other line of credit. You want to focus on your revolving accounts first — ones that don’t have a fixed number of payments or installments.

Pay on time.

If buying a home is on your radar, make sure you don’t miss a single payment on your bills or open accounts — no matter how small the balance may be. Set up alerts to remind yourself of each due date, or configure auto-payments so you don’t have to lift a finger. Just make sure you always have enough in your account to cover those bills once the auto-draft hits.

Stop using your cards and forgo any new loans or accounts.

Unless you can commit to paying off your charges in full every month, don’t add any more to your current credit cards. Steer clear of adding any new loans, cards or other accounts to the mix, too. These will show up as credit inquiries to a mortgage lender, and they could indicate you’re a high risk as a borrower.

Clear any collections.

If there are any collection agencies calling, it’s time to pay those debts off — and pronto. If possible, pay directly to the creditor you owe, not the collections agency. The original creditor may be able to completely close out your account and update your credit report if they’ll agree to it. If not, the collection will remain on your credit history for 7 years.

Double check your credit report.

Credit reporting errors are more common than you think, so pull your credit report now and double-check it for errors. Is all your personal information (SSN, name, address) correct? Are all the accounts shown actually yours? Are the balances and payment histories accurate? If you spot an error, you’ll need to dispute it with the credit reporting agency, as it could seriously impact your score.

Get your credit cards down below 30%.

If you can’t pay down your credit cards completely, at least try to get your balance down to 30 percent or less than your total limit. Anything over 30 percent utilization can negatively impact your FICO — especially if you’re using more than 30 percent across multiple cards

Avoid red flags.

When applying for a mortgage, you don’t want to do anything that could signal money problems on the horizon. Missing payments, paying less than you normally would or skipping a payment when you never have before, these are all red flags that something’s financially amiss — and that you might be a risk to your lender.

You Don’t Need Perfect Credit to Buy a Home or Refinance

It’s important to remember that your credit score isn’t the only thing mortgage lenders consider. And at the end of the day, if your credit’s not the best, that doesn’t automatically disqualify you from buying a home. In fact, according to Ellie Mae, the average FICO score on a FHA loan is 682, only a “fair” score by most standards.

Still, if home buying is on your radar, commit to changing your spending habits, set up payment alerts and start paying down your debts now — before it’s time to file your application. It can only make the journey easier (and more affordable) in the long run.

If you are ready to talk to someone about refinancing, buying a home or just need more advise on how to prepare for that purchase get in touch and we can chat.